Reliance’s financial services unit to offer insurance, merchant lending

Jio Financial Services, the financial services unit of Mukesh Ambani-run Indian conglomerate Reliance Industries, plans to expand to merchant lending and insurance, Ambani said at Reliance’s annual general meeting in a speech that is likely to have a repercussions for countless startups.

“JFS will massively increase financial services penetration by transforming and modernising them with a digital-first approach that simplifies financial products, reduces cost of service, and expands reach to every citizen through easily accessible digital channels,” he said.

“For tens of thousands of SMEs, merchants, and self-employed entrepreneurs, ease of doing business must mean ease in borrowing, investments, and payment solutions. JFS plans to democratise financial services for 1.42 billion Indians, giving them access to simple, affordable, innovative, and intuitive products and services.”

TechCrunch reported last week that Reliance was testing a sound box payment system at its campus. Analysts believe that the real allure of the sound box extends beyond its auditory alerts — it provides invaluable insights into merchant behaviors, facilitating the offering of loans based on this data.

The company will also enter the insurance segment, offering “simple, yet smart life, general and health insurance products through a seamless digital interface.” Jio Financial Services will explore partnerships with global players, he said.

“It will use predictive data analytics to co-create contextual products with partners and cater to customer requirements in a truly unique way,” he said.

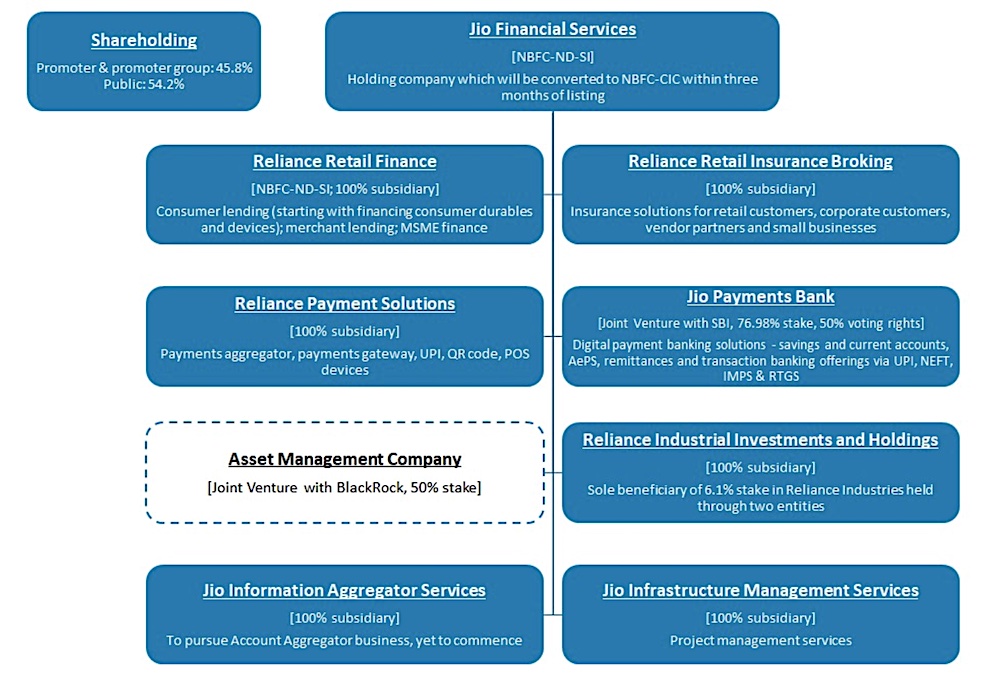

Ambani’s comments offer peek into the strategic trajectory of Jio Financial Services, mere days subsequent to the lackluster inauguration of the financial entity onto the public market. Reliance’s discussion about the future plans of Jio Financial Services has been somewhat limited so far, except for its earlier announcement of a joint venture with BlackRock.

Jio Financial Services company structure (Image: Morgan Stanley)

Jio Financial Services owns 6.1% in Reliance. Ambani said JFS operates in a sector that is very capital intensive, and Reliance has made it one of the “world’s highest capitalised financial service platforms at inception.”

“There is unprecedented opportunity to transform the asset management industry by introducing a full-service tech-enabled asset manager with affordable and transparent investment products to meet the needs of every segment of society,” said Larry Fink, Chairman and chief executive of BlackRock, at Reliance’s event on Monday.

Jio Financial Services will also explore blockchain-based platforms and participation in central bank digital currency, he said.

Ambani added:

I have three reasons to be absolutely confident about JFS achieving tremendous success over the next few years.

1. The digital-first architecture of JFS will give it an unmatched head start to reach millions of Indians.

2. This is a highly capital-intensive business. Your Company has provided JFS with a strong capital foundation to build a best-in-class, trusted financial services enterprise and achieve rapid growth. Reliance has capitalised JFS with a net worth of Rs 1,20,000 crore to create one of the world’s highest capitalised financial service platforms at inception.

3. JFS is blessed with a very strong board, led by Shri K.V. Kamath, a veteran and most respected banker. A highly motivated leadership team is being built with a combination of financial industry experts and young leaders who are eager to take on big challenges.

from TechCrunch https://ift.tt/tSIFUrB

No comments